In mid-July, Holt Lunsford Commercial published their Q2 2022 DFW Industrial Market Report. While Bob Moore Construction works in more than twelve market sectors in the commercial construction industry, industrial construction has been our bread and butter for many years.

MARKET OUTLOOK

In their overall market outlook, HLC says “as we look forward to the remainder of 2022, we expect the overall industrial market to continue strong as many of the large 3PL and e-commerce tenants are hiring and expanding in the DFW market.” In concluding their market outlook, HLC says “we expect DFW to outperform other parts of the country as it continues to be the biggest benefactor of large-scale relocation efforts and population growth.”

MARKET OBSERVATIONS

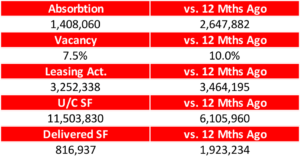

In market observations, HLC observes that “the development wave is still strong despite recent changes in the debt market” noting that tenant demand is helping counter this by providing confidence to developers through increased rental rates. “Continued tenant demand is evident as shown with strong leasing activity numbers through mid-year as compared to previous years” the report continues.

DFW TRENDS

In continuing trends, developers and contractors are having to navigate the increasing costs of shell construction and finish-out costs in addition to continued delivery delays on certain items, including dock levelers, steel, HVAC, and roofing materials. HLC notes that “spec work has started to also include dock packages due to extended lead times.” Other trends HLC notes include increasing rental rates, increased care and trailer parking requirements, increasing attention to the workforce, and pre-leasing activity.

MARKET TRENDS

In overall market trends, HLC says “supply chain shortages are driving companies to reevaluate their inventory needs and the right amount of safety stock” while “entitlements and building permits continue to be delayed as municipalities are overloaded with requests.”

Furthering the positive outlook on the industrial market, HLC notes that “the continued expansion of e-commerce fuels the increased demand for industrial space. Amazon has recently pulled back on their expansion but other large retailers and household brands are catching up.”

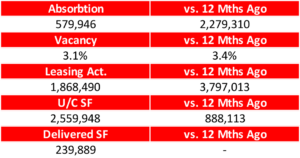

GSW/ARLINGTON

“Per CoStar reporting, the Great Southwest (GSW) industrial submarket concluded Q2 2022 with continued momentum… GSW reported 811,505 SF of new construction completions YTD and a total of 2,559,948 SF of new projects currently under construction… Forecasting further into 2022, we expect the GSW market to remain one of the top performing submarkets with continued rent growth as tenant demand continues to expand across the DFW market.”

In the GSW/Arlington region, Bob Moore Construction is currently working on the construction of the new addition to the Mouser Electronics campus in Mansfield. The new building, adjacent to the existing facility, will stand over 400,000 square feet and dramatically add to Mouser’s warehousing and shipping capabilities. FRS Design Group is serving as the architect.

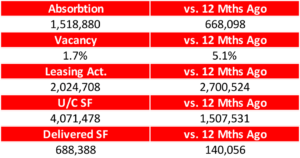

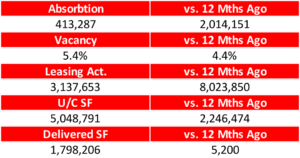

DFW AIRPORT

“The Dallas-Fort Worth (DFW) Airport industrial submarket closed 2021 with an all time low vacancy rate of 3.82% which has continued to drop through Q2 2022 and currently sits at a 1.7% vacancy rate per CoStar reports… Rental rates remained strong and are expected to continue to grow throughout 2022… Rental abatements are still prevalent depending on renewal versus new deals and the size of the lease transaction. Tenant improvement costs remained high because of increasing construction costs”

Within HLC’s DFW Airport Region, currently under construction is Valley View Point. Bob Moore Construction has partnered with ID3 Partners on the 120,000 square foot spec warehouse. Halff Associates is serving as the architect and engineer.

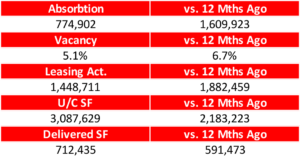

NORTHEAST/EAST DALLAS

“The Northeast/East Dallas submarket continues to be heavily sought after by tenants, developers, and the capital markets. With the Garland pocket posting a 1.9% vacancy rate, there is a clear need for additional space which sets the stage well for the new developments coming along the 635/Highway 80 corridor.”

In this region, Bob Moore Construction has two projects under construction: Perimeter Park and Sunnyvale West Business Center. Sunnyvale West Business Center, located at 300 US Highway 80, is a 202,104 square-foot spec industrial facility built for Flaherty Development and Langford Properties with Alliance Architects as the architect. Perimeter Park is a two-building spec industrial development near Garland developed by Core5 Industrial Partners and designed by Macgregor Associates Architects.

FAR NORTHEAST DALLAS

“The Far Northeast Dallas submarket continues to be highly sought after given its proximity to areas with exceptional population growth. Leasing activity has remained strong through Q2 2022 and is expected to continue with new tenant requirements coming to the market daily. Richardson and Plano have led the charge with the highest net absorption for this quarter while also posting vacancy near 5%. Functional warehouse spaces have become much harder to find in these pockets which sets the stage for the new developments that are getting started in Rockwall, McKinney, and Frisco.”

In late 2021, Bob Moore Construction completed work at McKinney Airport Commerce Center for Stonemont Financial Group. This two-building 231,119 square-foot spec industrial facility was listed in HLC’s Deals in the Market at the time of publication.

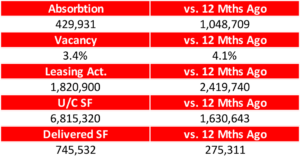

NORTHWEST DALLAS

“Through Q2 2022, the northwest Dallas industrial submarket continues to be one of the strongest performing submarkets in DFW. Valwood continues to be a haven for building supplies companies as well as 3PL’s with its direct access to I-35… The Metropolitan/Addison submarket is extremely tight from a vacancy standpoint as there are not any more available sites for development. Lastly, as developers move north to track down sites in Denton and Sanger, Highway 121 is now centrally located in the DFW market and an extremely desirable location for users.”

Bob Moore Construction recently delivered a new medical sterilization facility for Steri-Tek in Lewisville. Designed by Meinhardt & Associates, the facility stands 100,000 square feet and is the company’s first location outside of California.

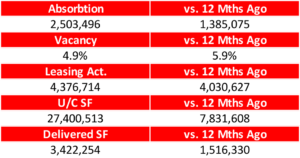

SOUTH DALLAS

“The South Dallas Industrial submarket as surveyed by HLC includes I-30, I-20, & I-45. This Submarket is 144 million SF and is now 5.2% vacant which is 0.3% lower than reported in Q1 2022. In accordance with the area surveyed, CoStar is reporting positive 2,908,620 square feet of Net Absorption in Q2 2022. South Dallas has approximately 27.4 million SF under construction in the I-30, I-20, & I-45 corridors combined with another 17.4 Million in the pipeline. Of the existing 27.4 million SF under construction, 25.4% or 7.0 Million SF is for Build-to-Suit or Design Build assignments or has been pre-leased. The remaining 74.6% or 20.7 million SF under construction is speculative development.”

In South Dallas, Bob Moore Construction is currently at work on I-20 Logistics Park, on Cedardale Road. This 1,013,075 square-foot industrial facility is developed in a joint-venture by Ares Management, formerly Black Creek Group, and Archway Properties. The facility is the first of a planned two-phase master plan with GSR Andrade serving as the architect.

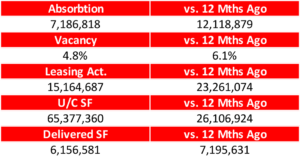

NORTH FORT WORTH

“North Fort Worth continues to be the top performing submarket in DFW in terms of deal velocity and overall net absorption. After the record-setting, annual posting of 7.5M SF for 2021, the submarket has already achieved nearly another 5M SF of net absorption YTD with most transactions being with new tenants to the market… Even with the recent Federal rate hikes, investors and landlords alike should remain confident in North Fort Worth’s unshaken leasing activity as new opportunities present themselves.”

Bob Moore Construction has built millions of square feet of industrial space in the North Fort Worth Region. We recently completed work on MDC 50 for Mercantile Partners in Fort Worth. This 635,000 office and warehousing facility was designed by GSR Andrade and will house a large freight transportation company.

Currently under construction is Mercantile West, a 716,000 square foot two-building spec facility for developer Marc Goldman.

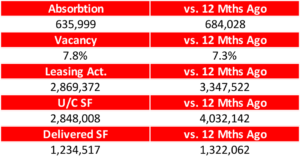

SOUTH FORT WORTH

“The South Fort Worth industrial submarket posted a Q2 2022 vacancy of 7.8%, a figure slightly up from the 7.3% recorded in Q1 2022. This vacancy rate stagnation correlates with the ~2M SF of new deliveries and the ~1.4M SF in absorption that were confirmed this quarter. This leasing activity further validates South Fort Worth’s position as one of the top performing submarkets in the metroplex.”

“Furthermore, we expect to see the vacancy rate decrease through the remaining two quarters of 2022 with 1.9M SF of active deals tracking to be made in the submarket in contrast with the ~500K SF of expected new construction deliveries. Looking forward to 2023, the South Fort Worth speculative development pipeline is currently slated to deliver over 2.1M SF with additional projects on the cusp of announcement that will bolster that figure.”

Bob Moore Construction is currently working on both Phase I and II of VanTrust’s Fort Worth Logistics Hub. In late 2021 the Phase I shell, standing 670,914 square feet, was delivered and work on the tenant interior is currently underway. Now the shell of Phase II, which will stand 606,480 square feet. Fort Worth Logistics Hub Phase I and II is designed by Alliance Architects.